Financial industry: validate and onboard customers, ensuring security and compliance with regulations

Simplify your KYC and AML processes; and mitigate fraud without affecting the user experience

FINANCIAL INSTITUTIONS THAT TRUST TRUORA

KYC technology that facilitates regulatory compliance

Simplify the onboarding of new users for financial industry products

Accelerate the onboarding of trustworthy customers

Simplify access by integrating 100% automated validations

Prevent fraud and

reduce losses

Receive key information and detect suspicious activities

Guaranteed regulatory compliance.

Eliminate risk by complying with regulatory standards

Ensure the onboarding of new customers to your financial services

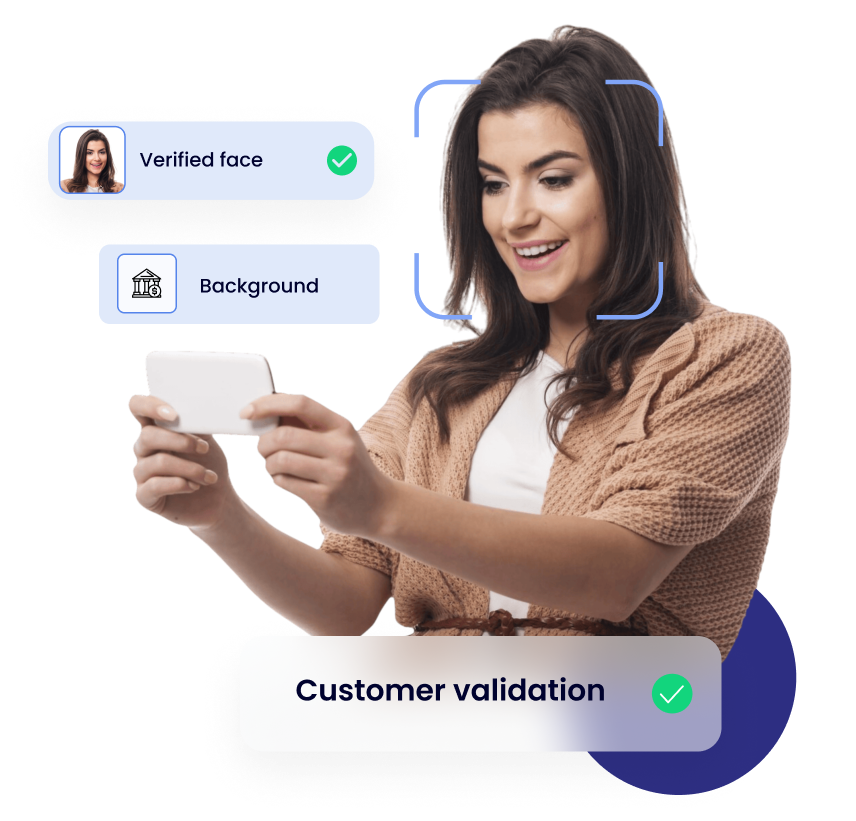

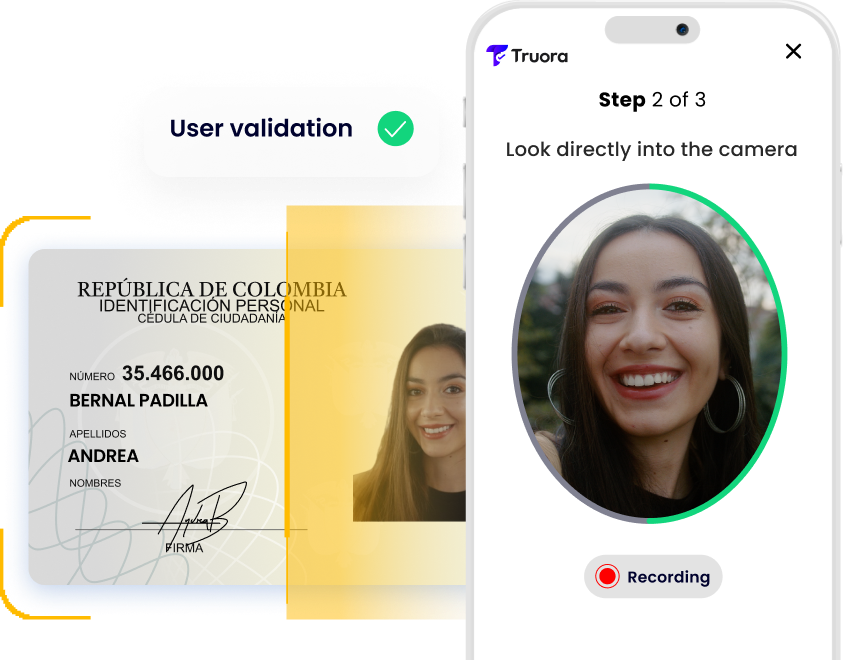

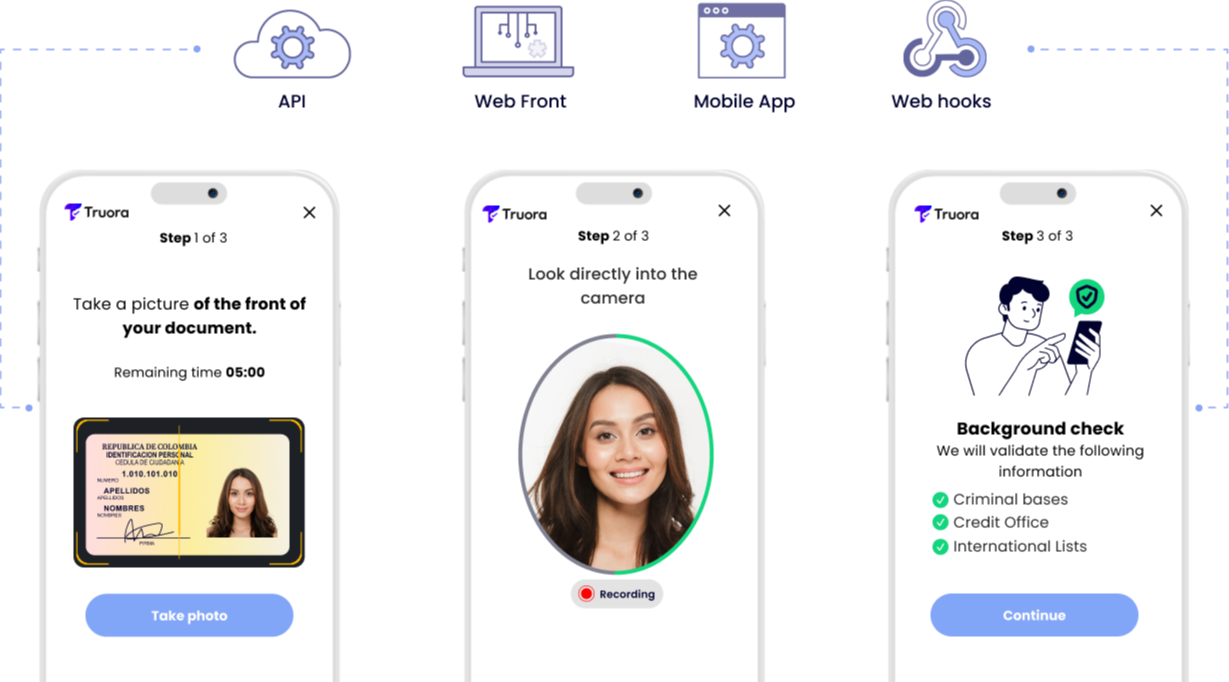

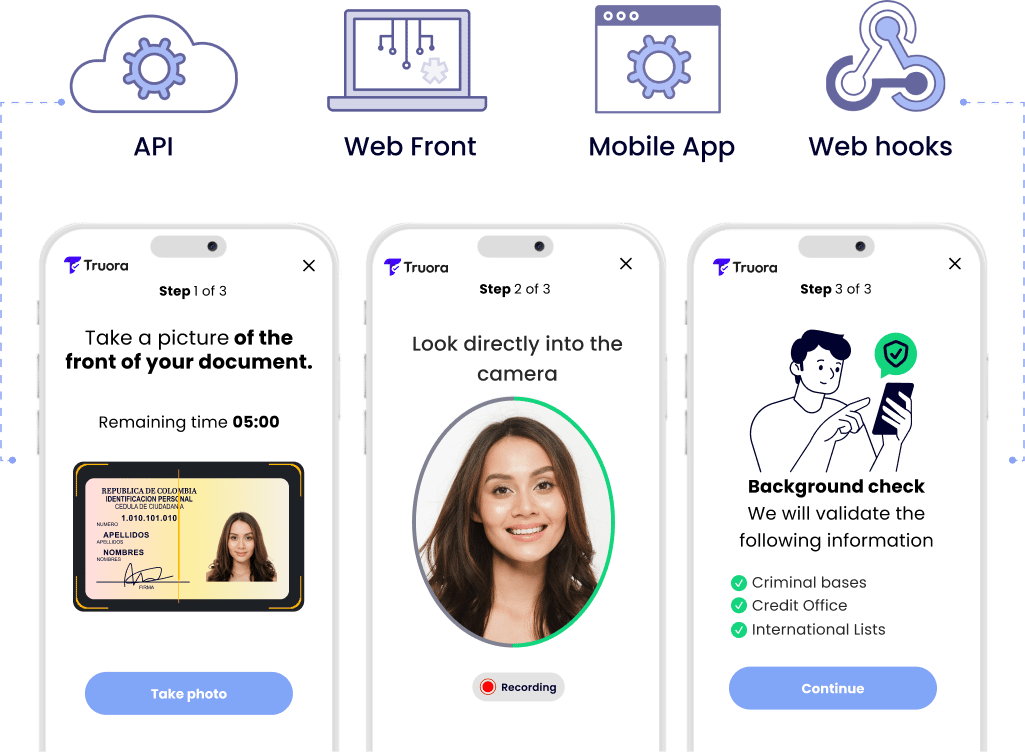

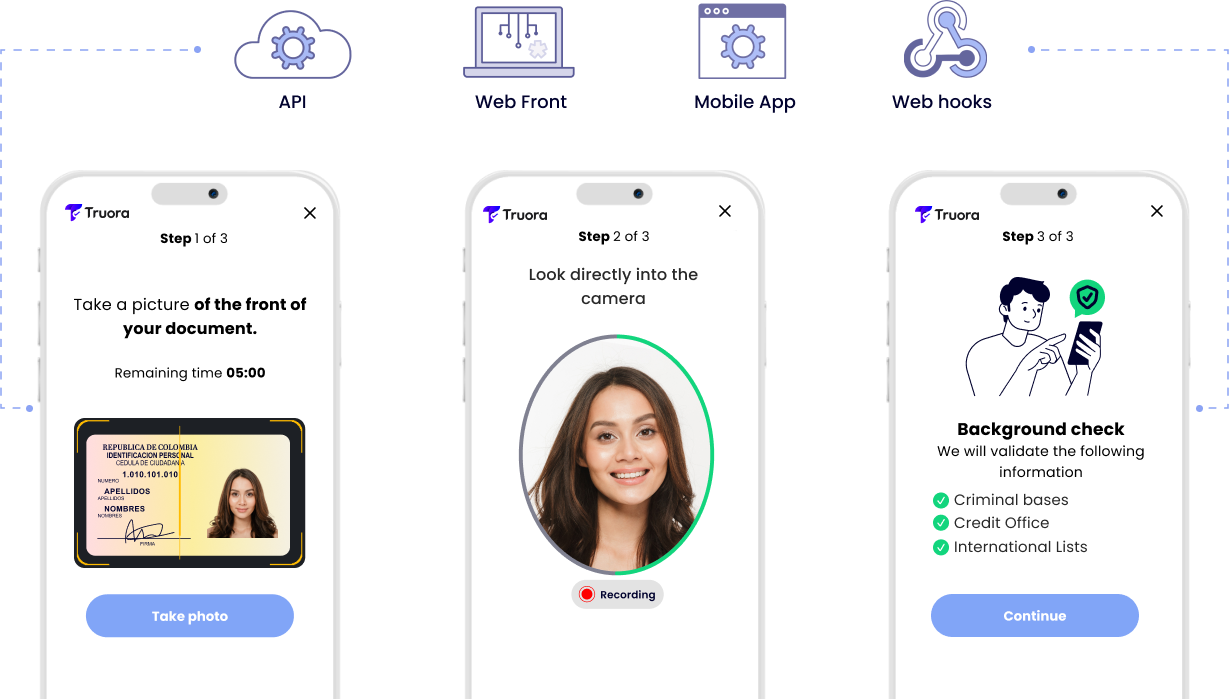

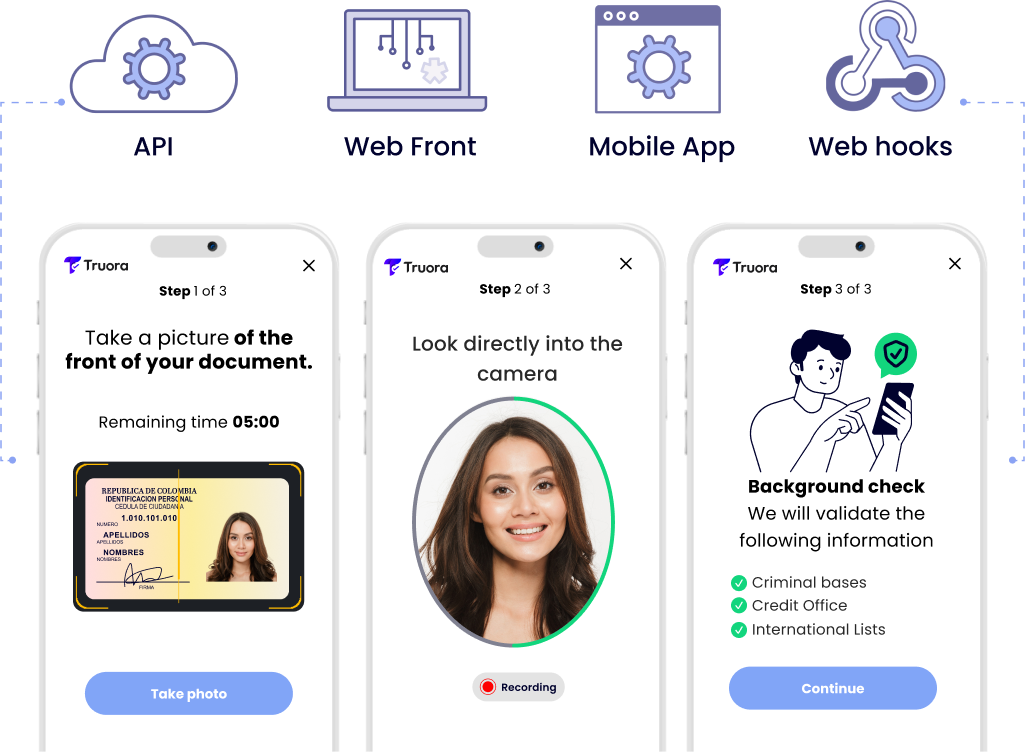

Activate digital validation flows as simple or comprehensive as needed. You can include checks for:

-

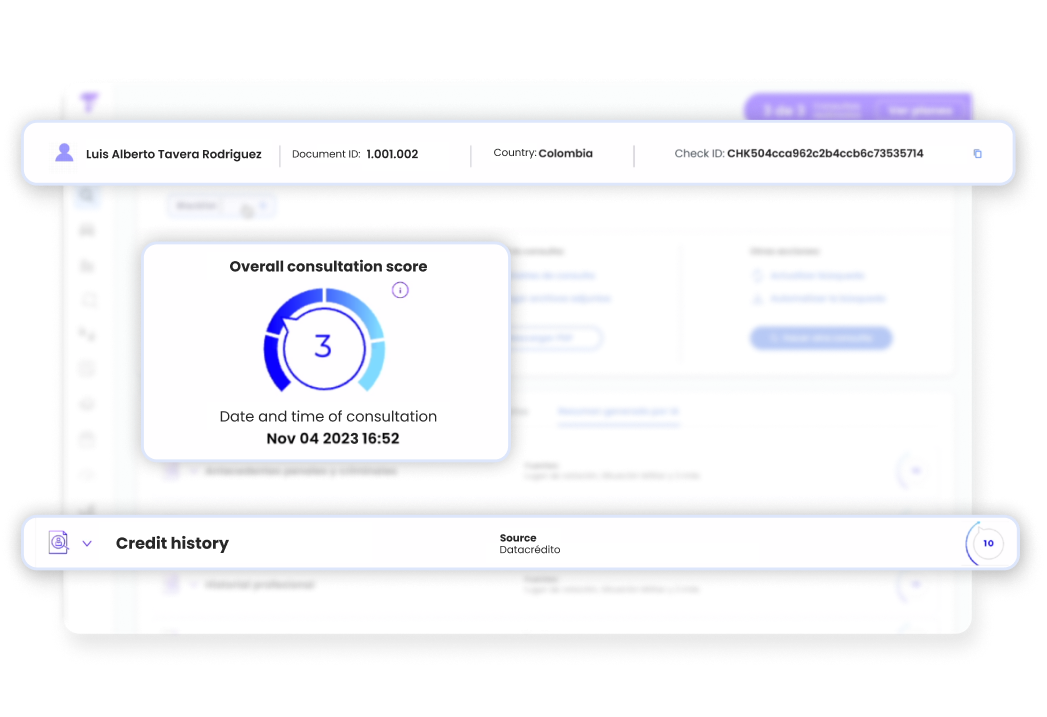

Personal, criminal, and credit history

-

Identity document

-

Facial recognition / Selfie

-

Residence address, phone number, and email

All within minutes, integrated into your services, and with a guided experience for your customers, avoiding drop-offs.

Activate risk alerts and monitor any suspicious activity

Assign automatic decision rules and monitor any changes to avoid risks in your bank, reducing response times and operational costs.

Obtain key data and information to profile your audience, identifying opportunities for your financial services.

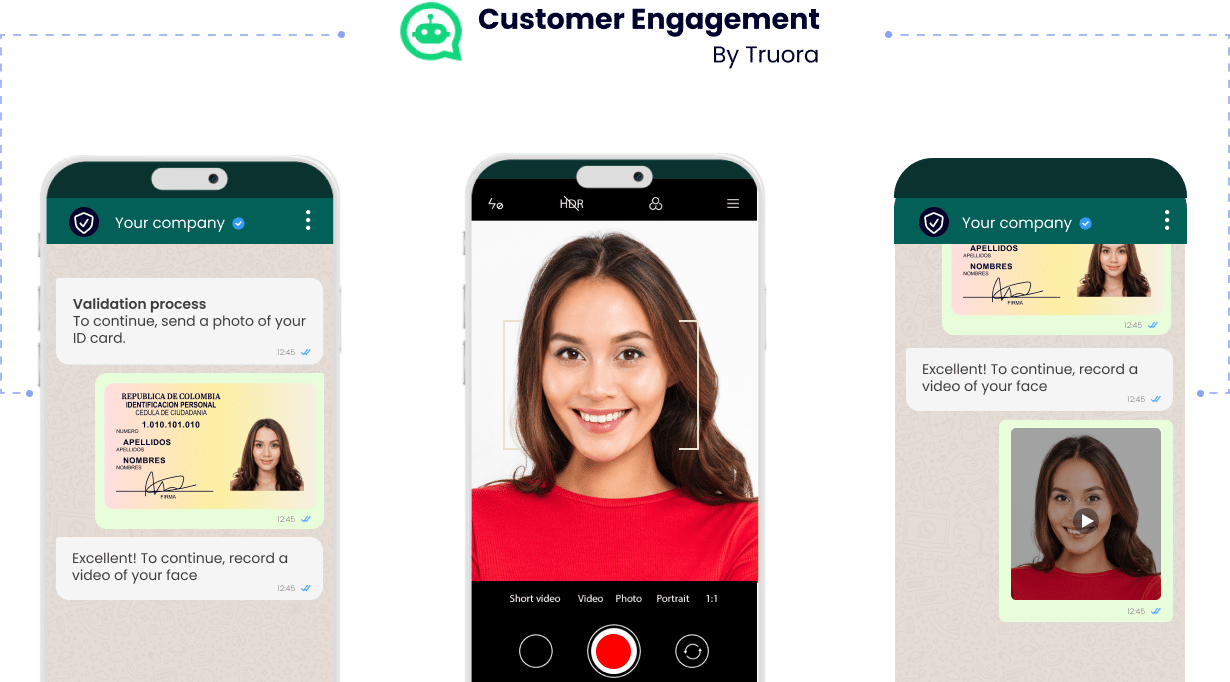

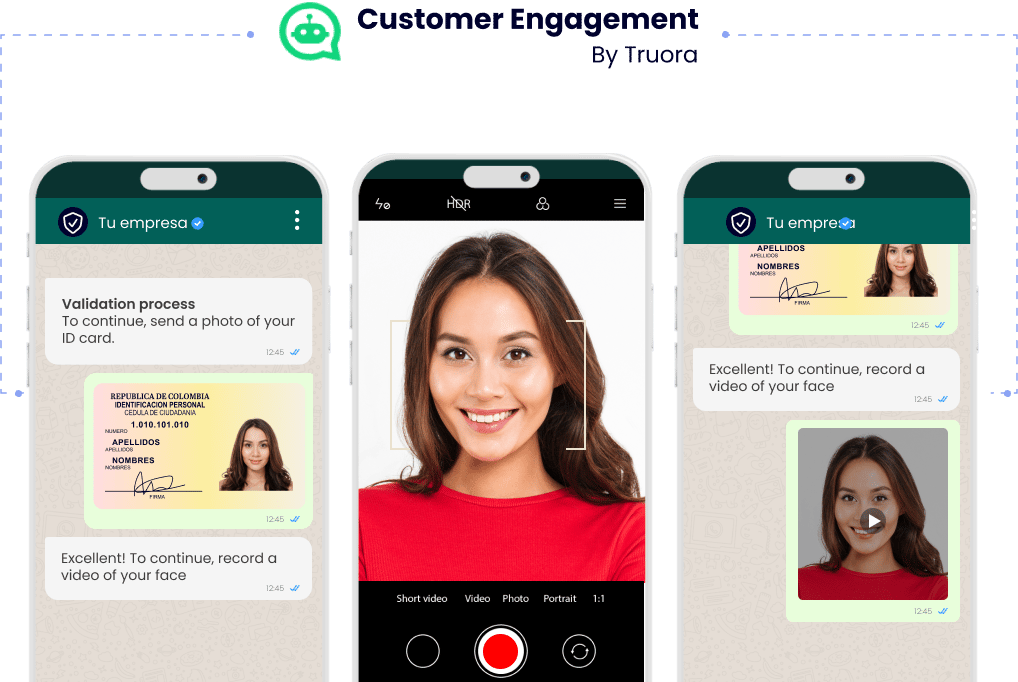

Achieve a higher contact rate with your debtors and reduce human intervention

Enable friendly reminders and facilitate on-time payment from your customers without the need for repetitive processes or long calling sessions. Configure automatic responses and let the bot handle collections for you.

Integrate an efficient and comprehensive validation experience

Which also works on WhatsApp

Integrate an efficient and comprehensive validation experience

Learn how Truora solves challenges in the financial industry

Request a free consultation with our team of experts.

Discover our impact on other companies

Luis Velasco

Maria Fernanda Bonilla

Diego Lopez

Felipe Villamarin

Diego Torres

Ensure security and trust

.webp)