Make your identity verification quick and easy while:

Convert more users

Prevent fraud

Meet regulatory compliance

Save time and money

We offer you a set of different validators to choose from

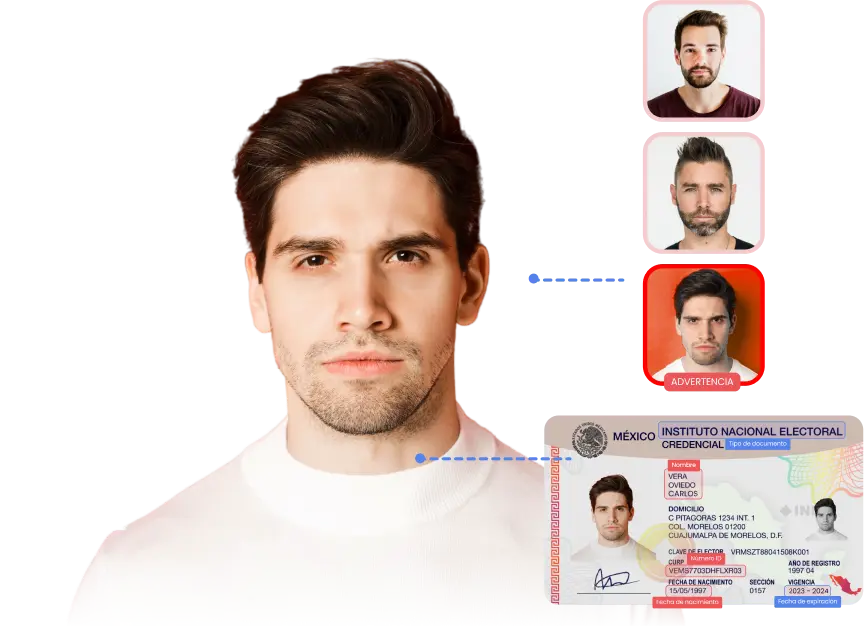

ID Document Verification

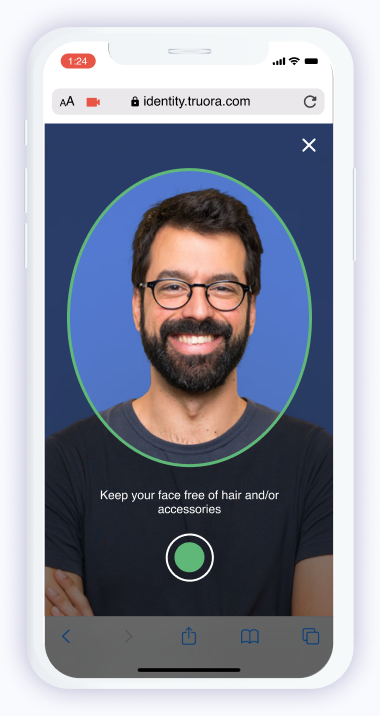

Facial recognition

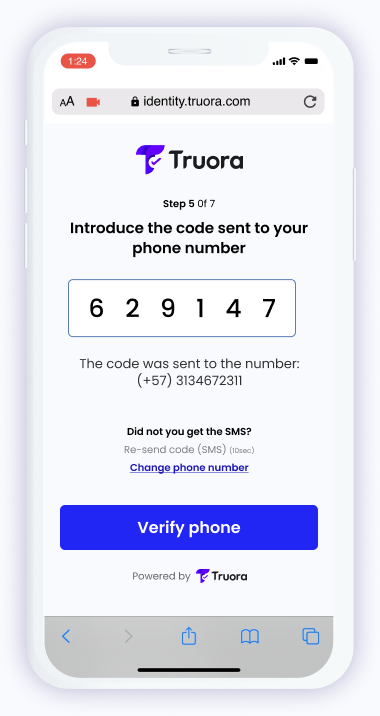

Phone verification

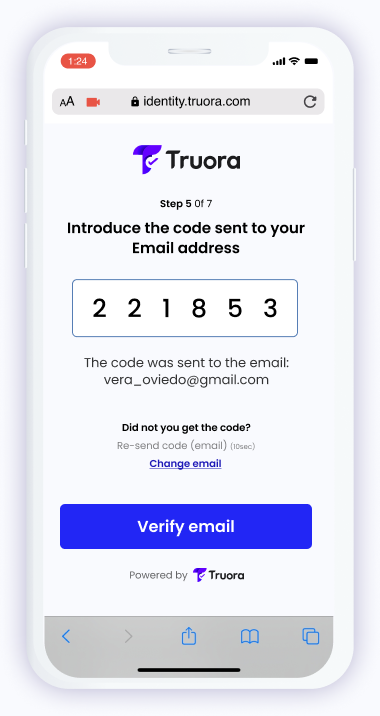

Email verification

Upload document photos

Ask your users to upload photos of their ID documents such as national identity card, driver license and passport.

Extract data automatically

Through OCROptical Character Recognition is a technology used to extract text from image format. Can be used to process and validate data from pictures of identity documents. technology, Truora automatically extracts data such as name, ID number and date of birth from the document photo.

Validate data using anti-fraud models

Based on the extracted data, Truora runs several anti-fraud models to validate the authenticity and consistency of the information.

Manual review by DI experts team

If your business requires it, a team of DI experts will double-check failed validations to increase the level of conversion rate.

Grant or Deny Access

Once validated, instantly grant or deny access to the next steps of your onboarding process.

Set up a image of reference

Ask your users to upload a photo of a valid government-issued ID (driver’s license, passport or ID card) to establish an image as a frame of reference

Upload a selfie or a video

Ask your users to upload a real time selfie or short test video.

Validate user face using accuracy models

Our face recognition technology will determine if the face on the selfie/video uploaded by the user matches the face on the image of reference.

Manual review by DI experts team

If your business requires it, we will double-check automatic face validations to increase the level of conversion.

Grant or Deny Access

Once validated, instantly grant or deny access to the next steps of your onboarding process.

Request Phone Number

Ask the users phone number and country of origin

Send an SMS OTP

User will receive a One-Time-Password to verify their phone number

Verify it's a Match

Instantly verify if the OTP is correct

Check the line’s level of confidence

If your business requires it, get phone line score of confidence to filter out fake or suspicious numbers

Grant or Deny Access

Once validated, instantly grant or deny access to the next steps of your onboarding process

Request Email Address

Ask the user’s email address through our platform.

Verify Email details

We verify the email’s existence, syntax, bounce risk and whether it comes from a disposable email address.

Send an Email OTP

User will receive a One-Time-Password to verify their email address.

Verify it's a Match

Instantly verify if the OTP is correct

Grant or Deny Access

Once validated, instantly grant or deny access to the next steps of your onboarding process

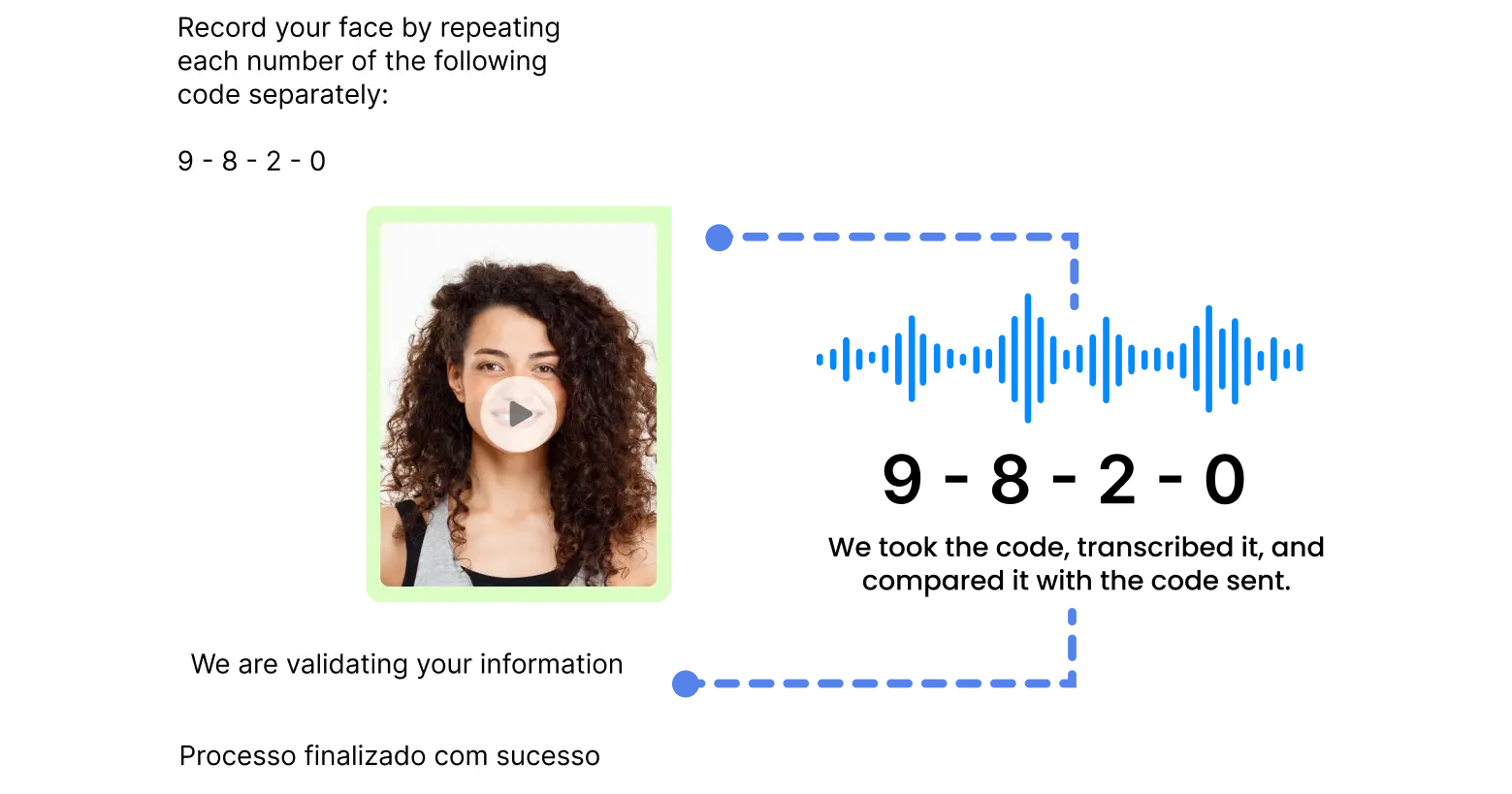

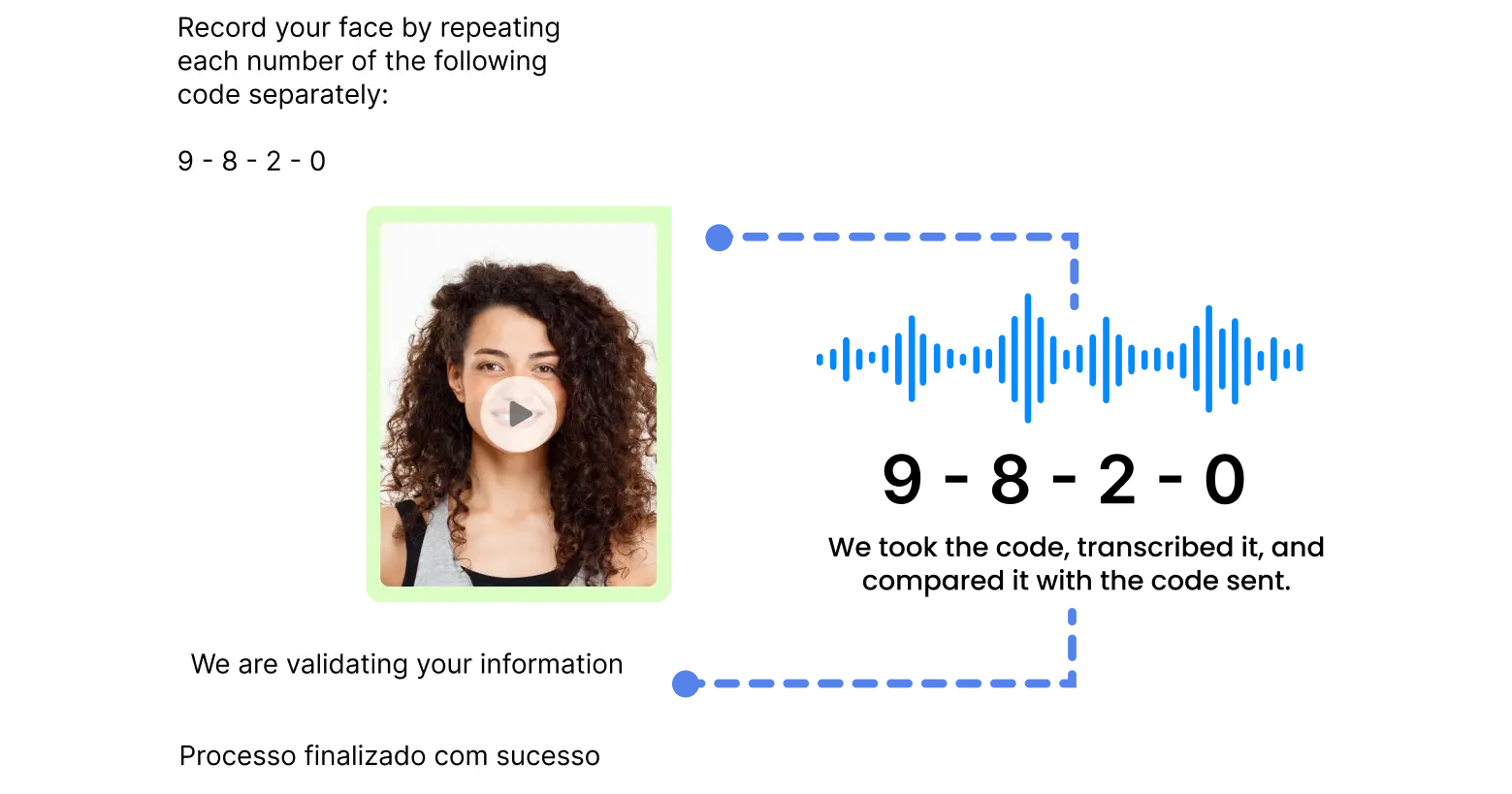

Audio and Face Validation

During the process, the user can submit a live video test while reciting a random code that’s sent to this same WhatsApp conversation.

This validator can be combined with other verification methods for multi-factor authentication.

Why trust Truora with the DI verification process?

We have built a strong set of capabilities to provide you a superior verification process

Combine our digital validators with our team of DI experts: Receive support from a specialized ID team to double-check failed validations. This added layer of security increases the success rate of verification.

AI anti-fraud models: We are continuosly training and improving our anti-fraud models to stay one step ahead of fraudsters.

Official government partners

How are our clients using our digital identity verification?

Compliance of KYCKnow Your Customer. Regarding the practices that companies implement to verify their customer's identity and comply with current legal requirements./AMLAnti-Money Laundering. Regarding the business controls to identify or prevent behaviors related to money laundering. for user onboarding

Fincomercio automated and simplified their user onboarding process while being KYCKnow Your Customer. Regarding the practices that companies implement to verify their customer's identity and comply with current legal requirements./AMLAnti-Money Laundering. Regarding the business controls to identify or prevent behaviors related to money laundering. compliant. With our solution Tuya could onboard more users and grow faster.

Industries:

Selling financial products in digital channels

In order to grant loans to its customers securely and through digital channels, Fundación Grupo Social has implemented our identity validators.

Industries:

How to use our solutions ?

API

Web Front

WEB view

Guarantee trust and security

.webp)

Plans and pricing

Included features

Platform for the creation of digital identity validators

Web, WhatsApp and API integration

Customer Support

We offer you a set of different validators

for you to choose from

Document validation

Background checks

Face validation

Phone/email validation

Validation via WhatsApp

Validation available by purchasing the advanced Customer Engagement plan View plan