Buy Now Pay Later

In only 5 minutes, Addi's users can obtain digital credits at stores by validating their identity with Truora.

-

80%

Reduction in fraud

thanks to TruFace -

+60%

User conversion

in Colombia -

+300k

Validated documents

in 2022

Addi’s objective

To drive and enable digital commerce in Latin America, allowing users to buy what they want, when they want, in an easy, fast and transparent way.

Necessity

The main need of Addi lies in facilitating access for new users to immediate digital credits requested in stores or physical shops by validating their identity.

Addi faces the challenge of minimizing fraud to the greatest extent possible and avoiding the loss of potential customers.

"At Addi💸 we needed to implement an efficient identity validation process in order to grant fast and secure credits for the businesses."

The Solution

Integrating an identity validation flow into the process of granting credits to new users

What did we do for Addi?

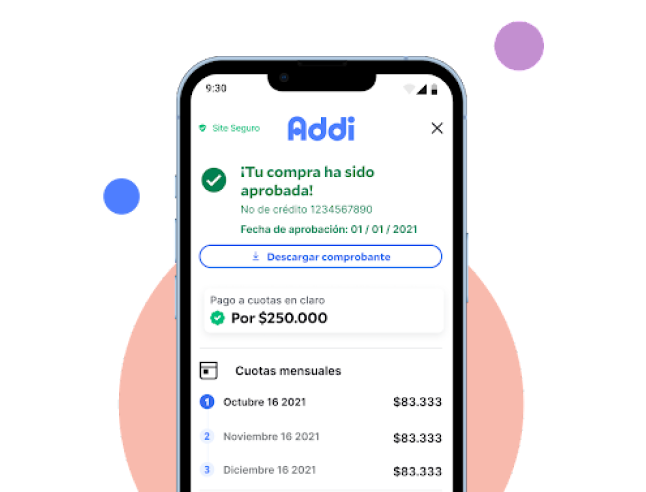

At Truora, we integrated a validation and biometric authentication flow via API into Addi's services, enabling potential customers to obtain immediate credits using their ID to finance their purchases within minutes and with minimal friction.

"We were able to expand our operations and grow sustainably with the help of Truora by improving the validation process and reducing human dependency."Luis Velasco

Senior Product Manager at Addi

Integrated Validators:

Validation of the identity document

of the user applying for credit, which compares the document with legal databases and fraud models focused on detecting identity theft.

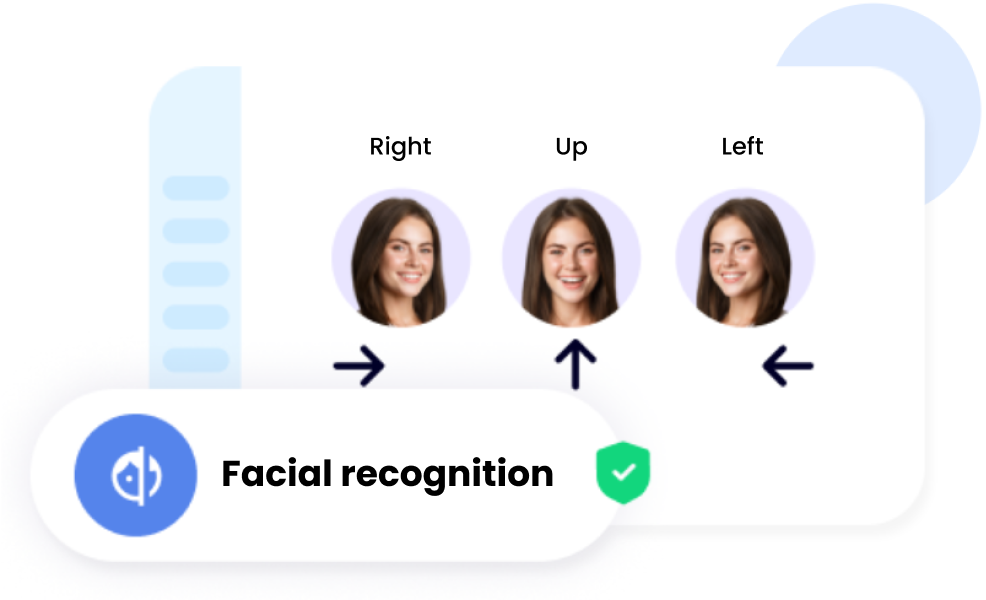

Facial recognition

through a liveness test (video of a moving face).

TruFace validation that compares facial biometrics with a database of reported faces.

Thanks to the integration between Addi and Truora, the prior’s customer conversion increased by 60% since implementation. Moreover, customer acceptance and satisfaction increased by 96%